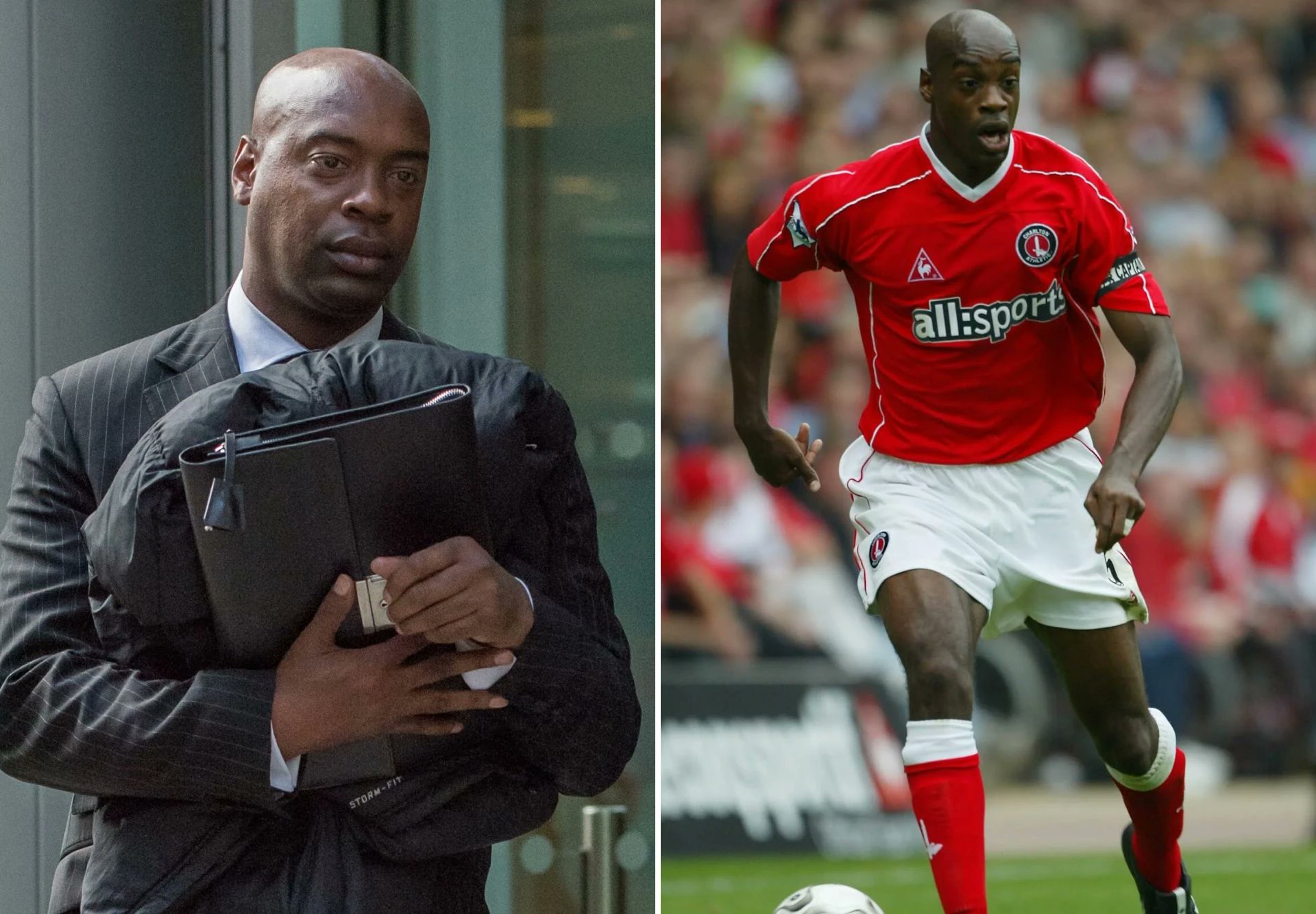

Former Premier League footballer, Richard Rufus, who scammed his friends out of £8m to maintain his luxury lifestyle after he retired, was jailed for more than seven years today.

The Ex-Charlton Athletic defender, 48, duped his victims into investing in the foreign exchange market by promising them incredible yields in what was reality a pyramid scheme.

Rufus, who won six caps for the England under-21s, claimed ‘football friends’ such as former England and Manchester United defender Rio Ferdinand had invested with him.

He drove a Bentley and lived on an exclusive private estate on the money he was swindling, Southwark Crown Court heard.

Posing as a successful foreign exchange trader, Rufus claimed he had been headhunted by some of Britain’s largest financial organisations, including Morgan Stanley and Coutts. But he was so incompetent he invested £5m for his church as a ‘blessing’ and lost them £3.5m.

Rufus insisted he was doing friends and family a ‘favour’ by handling their cash.

He apologised for losing their money and said: ‘I am absolutely remorseful for my family and friends. It all started to help them to make money and in the early 2000s that is what we did.

‘We carried it on to the mid-2000s and I always had a good intention. I have lost absolutely everything and I don’t want people to feel sorry for me.

‘Even though it has made me bankrupt, it is still my intention to make amends in relation to what happened. Especially watching my family and friends’ step into this witness box this past week.’

Rufus’ home was repossessed in 2012 and he was declared bankrupt in October 2013.

He denied but was convicted by a jury of three counts of fraud, one count of possessing criminal property and one count of carrying on a regulated activity when not authorised.

One of the fraud charges related to former Chelsea and Villa defender Paul Elliott.

‘He was chased by mortgage and credit card companies for years. He had to tell his children not to open the door in case it was the bailiffs.’

In his statement, Mr. Clarke said he has suffered ‘death by a thousand lies’

Another victim, Vincent Naire, said Rufus has ‘demonstrated no empathy’ to his victims.

Jailing Rufus for seven and a half years, Judge Dafna Spiro told him: ‘The victims of this fraud are haunted by your actions.

‘The people who invested did so in good faith, they believed your spiel because they thought you were the real deal.

‘You were robbing Peter to pay Paul. You were living a lie at the expense of others.’

The fraudster showed no emotion as he was led from the dock.

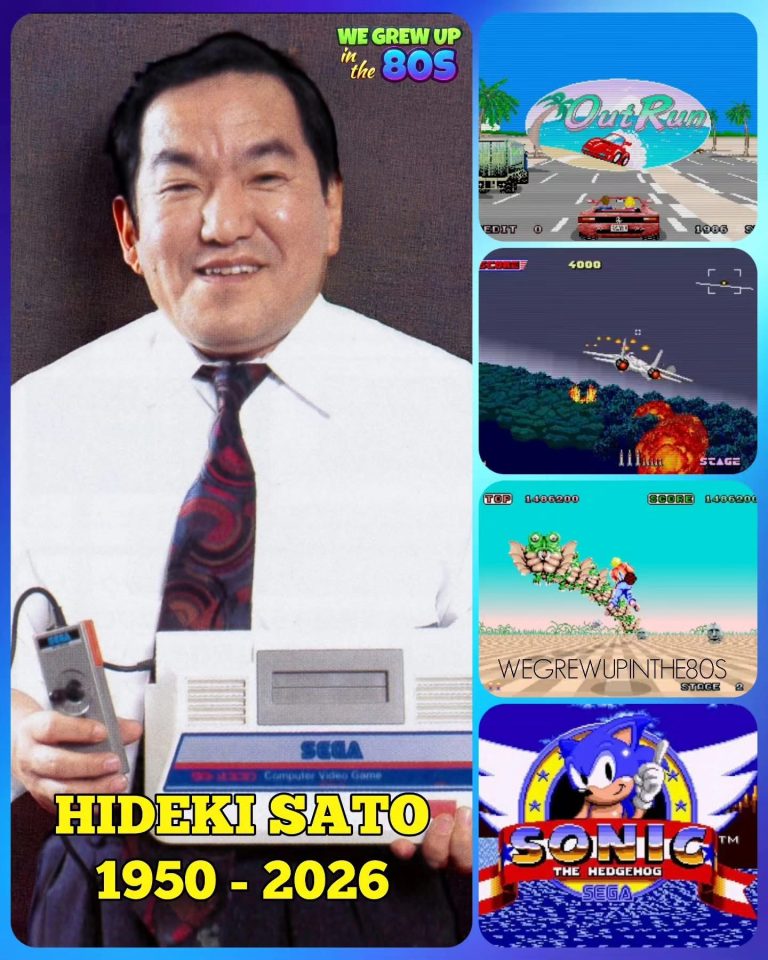

Rufus was offered an apprenticeship at Charlton at the age of 16 and secured a place in the first team two years later.

He helped the Addicks win promotion to the Premier League in 1998 via the Wembley play-off final when he scored his first ever senior goal against Sunderland.

After making 288 appearances for Charlton, scoring 12 goals, and unsuccessful knee surgery, he retired from football in 2004 and launched a career in the financial sector.

Rufus had all the trappings of wealth, living in a big five-bedroom house in Purley, south London, driving a luxury cars, and wearing Rolex watches.

According to his friends he kept up the footballer’s lifestyle, long after his retirement, but he was living a lie.

‘He scammed friends, family and associates out of millions of pounds by pretending he was able to offer a low-risk investment in the foreign exchange market,’ said Lucy Organ, prosecuting.

‘He claimed he had significant success with his strategy in the past.

‘He claimed he could, and did, get massive profits of five per a month which equates to 60 per cent a year.

‘He claimed that investors original investments or capital were safe and could be returned to them within 14 days of them asking.

‘The investments were in fact fraught with risk. Rather than returning the profits they were promised, they lost a great deal of money.

‘Mr. Rufus took over £15million in total. He traded some of it, as I have said, losing vast amounts, but that wasn’t the end of the fraud.

‘Of that money, about £2million he never even transferred to foreign exchange trading accounts. He used this money partly to prop up the losses that his scams were making.

‘Making payments back to other investors to continue the pretence that they were making a good investment, a so-called “pyramid scheme” and partly simply for his own benefit, treating the money he received from investors as his own.’

Of the £15million paid by investors to his personal account for trading, only £7million went into his trading account.

At least £2million was kept in his personal account with some investments transferred to family members.

Eventually, Rufus had his accounts frozen by the Financial Services Agency on February 11, 2011.

‘Even when he stopped trading, he continued to take money from investors who he duped,’ the prosecutor said.

‘That money too was never invested and never went near a trading account. He used this money to either further the fraud by paying investors fake profits or simply as his own money.

‘Whilst paying investors fake profits, paying back so called capital, he simply paid his own bills with that money.’

Rufus joined the Kingsway International Christian Centre (KICC) as a Board trustee in 2005.

The church was persuaded to invest £5.1m, but only received £1.4m back.

Detailing Rufus’s lavish spending the prosecutor said: ‘He had a mortgage with the Bank of Scotland that cost him approximately £9,000 per month.

‘A third of his personal expenditure was on mortgages and loans, an amount over five years of nearly £700,000, with an average of over £11,000 per month.

‘He also spent £200,0000 on motoring costs with over £70,000 to Mercedes Benz Finance and payments of over £45,000 to Mercedes Croydon and over £46,000 to Land Rover.

‘He transferred £222,468 to his wife, Simone Rufus and £158,513.86 to a joint account held with his wife.’

Giving evidence, Mr. Elliott, 58, said he and Rufus both suffered career ending knee injuries and he agreed to invest in his friend.

He told the court: ‘He said he had been trading for friends and family. He explained the methodology was that he had created this “IP”, Intellectual Property.

‘He created his own design, his own style, his own intellectual property that enabled him to be very, very successful.

‘He said he made colossal sums of money for his church and friends and family. It was millions.

‘He said what was very important for him was his legacy. He said he wanted to create a legacy.

‘The make-up of his church was predominantly black and some from low socio-economic background, so he wanted to create a legacy. He wanted to be a wealth creator to make them comfortable.

‘He actually said that he was being sourced by a number of global corporate entities such as Barclays and Coutts.

‘He said he was so successful that these companies wanted to headhunt him and he resisted that engagement because he wanted to do right by his parishioners, his friends and family, and the church.’

Rufus also claimed to be investing money for other footballers but Mr Elliott was notified that the FCA had frozen Rufus’s accounts in 2011.

He was declared bankrupt in October 2013 after a proposed Individual Voluntary Arrangement failed.

Ms. Organ added: ‘He continually promised people that he would make them very high returns on their investments. He promised that their capital would and was safe. He said capital could be returned to them within 14 days.

‘He continued the lies by either saying there was profit being made by their investments and that it was being ‘re-invested’ and so the amounts held by the investors was increasing, or by actually making profit payments to them.

‘This was all fraudulent since there was no profit and in fact the capital from the investors was not safe and couldn’t be returned by Richard Rufus to them because he was either using it to support the pyramid scheme and make so-called ‘profit’ payments or he used it for his own ends.’

Rufus, of Anerley Hill, Crystal Palace, south London, denied three counts of fraud by false representation, one count of possessing criminal property and one count of carrying out a regulated activity when not authorized, between May 2007 and April 2012.