In a startling revelation, the Central Bank of Nigeria (CBN) faces scrutiny over its inability to account for a staggering $4.5 billion missing from Nigeria’s foreign reserves between 2018 and 2019, as disclosed by the Auditor-General of the Federation.

The Office of the Auditor-General of the Federation (AuGF) unearthed this discrepancy, highlighting a significant gap in the nation’s financial records during the specified period.

According to the audit report, Nigeria’s Foreign Reserves, which amounted to US$42,594,842,852.75

in December 2018, plummeted to

US$38,092,720,200.72 by the end of 2019.

This stark reduction of US$4,502,122,652.03 raises serious concerns about accountability and transparency within the CBN’s operations.

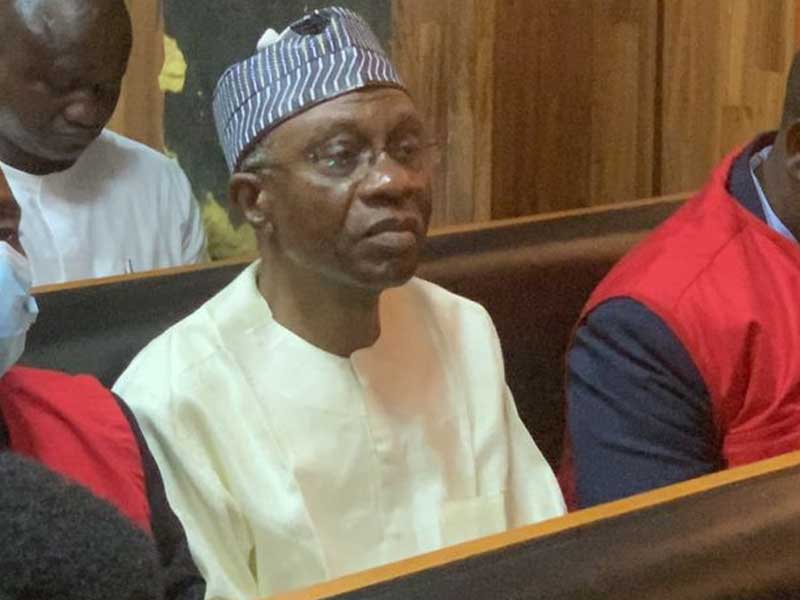

The audit report attributes this violation to lapses in financial management during the tenure of Godwin Emefiele as the Governor of the CBN, particularly amidst the challenges posed by the COVID-19 outbreak.

Shaakaa Chira, the Auditor-General of the Federation, has called upon the CBN to provide a detailed explanation for the missing funds, emphasizing the imperative of adhering to Section 25 of the Central Bank of Nigeria Act, 2007, which mandates the maintenance of external reserves at appropriate levels for the nation’s economic stability.

Furthermore, the audit report flagged another ‘unsubstantiated’ decline of over $8 billion in foreign reserves between 2019 and 2020, indicating a deeper systemic issue within the CBN’s internal control mechanisms.

Highlighting the significance of effective economic management, the Auditor-General underscored the need for the CBN to bolster its internal control systems to mitigate risks that could adversely impact the nation’s reserves and monetary stability.