Screenshot

The Central Bank of Nigeria (CBN) has directed all financial institutions to begin submitting detailed monthly reports on the activities of their Point-of-Sale (POS) agents as part of new measures to enhance transparency and tighten regulation within the nation’s expanding agent banking sector.

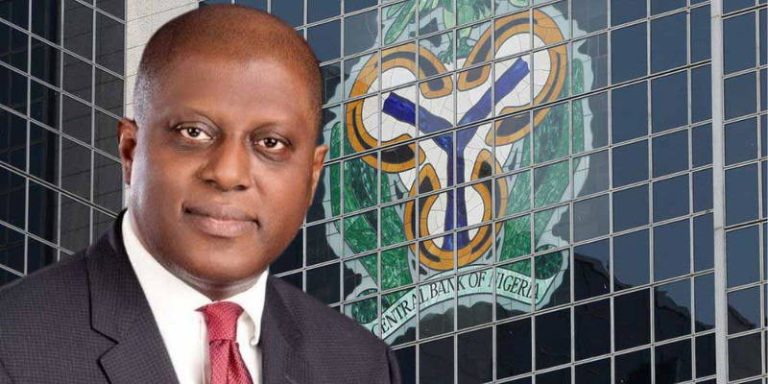

In a circular signed by Musa Jimoh, Director of the Payments System Policy Department, the apex bank stated that the move aims to improve oversight, mitigate risks, and promote accountability across financial institutions. The CBN mandated that the reports must include comprehensive data on the nature, value, and volume of transactions conducted by agents, with submissions due no later than the 10th day of each following month.

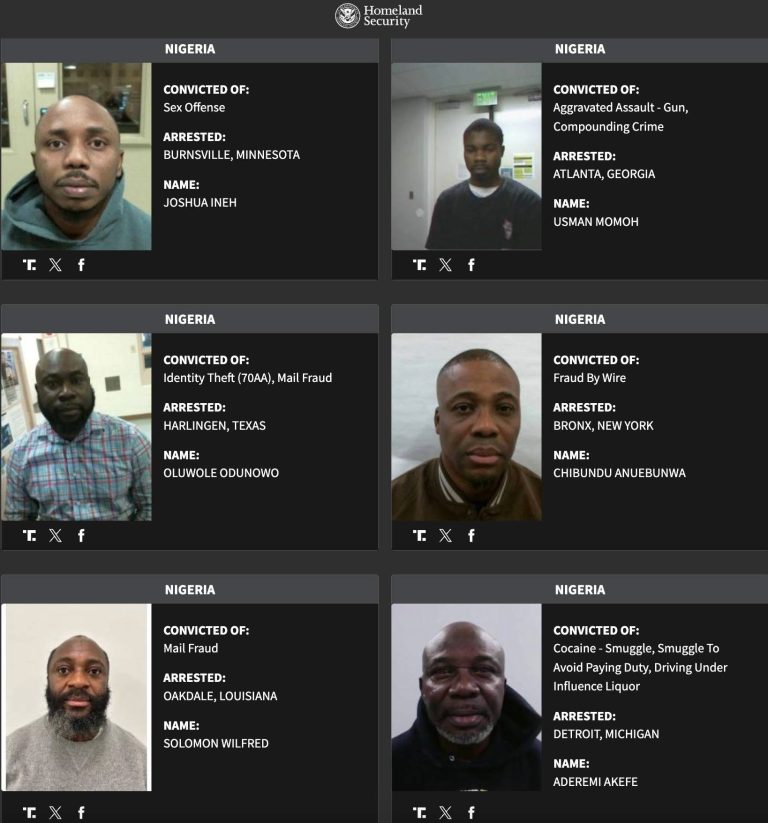

According to the directive, financial institutions are also required to provide detailed information on incidents of fraud, theft, or robbery at agent locations, as well as the number and type of customer complaints and remedial actions taken. The report must classify active agents, record any operational breaches, and include full agent details such as phone number, BVN, TIN, business address, and geopolitical zone.

Additionally, the CBN ordered institutions to document agent training programs covering Anti-Money Laundering (AML), Counter-Financing of Terrorism (CFT), fraud detection, reconciliation, counterfeit identification, and customer service. On-site inspection reports and exceptions observed during monitoring are also to be included.

“All returns submitted to the CBN shall be duly signed by the Managing Director/Chief Executive Officer and the Chief Compliance Officer,” the circular stated, warning that any submission made later than ten working days after the end of the reporting period will be deemed a breach and attract regulatory sanctions. The directive takes immediate effect.

The CBN reaffirmed existing transaction limits introduced in December 2024, maintaining that POS agents may not exceed ₦1.2 million in daily transactions, while individual customers are limited to ₦100,000 per day. The limits, according to the apex bank, are designed to curb misuse, strengthen financial integrity, and safeguard consumers.

The latest move comes as part of the CBN’s broader strategy to enhance regulatory oversight and combat fraud in Nigeria’s payment system. In August, the bank issued a related directive requiring all licensed financial operators to migrate to the ISO 20022 messaging standard and implement mandatory geo-tagging of payment terminals by October 31, 2025.

The CBN said the migration aligns with the SWIFT global timeline and aims to standardize data quality across the country’s financial ecosystem, reinforcing Nigeria’s position within the international payment infrastructure.