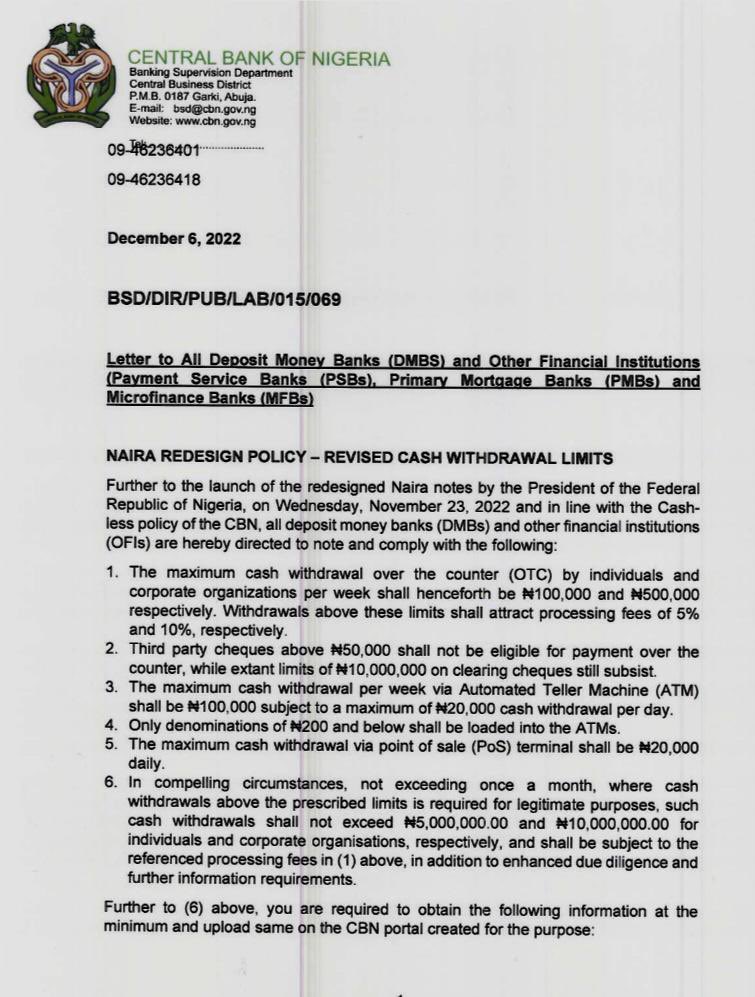

The Central Bank of Nigeria (CBN) has announced a new policy that mandates banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals and corporate entities do not exceed N100, 000 and N500, 000, respectively, per week.

The revised cash withdrawal limits, contained in a circular issued today will take effect nationwide on January 9, 2023.

The new policy stated that the maximum cash withdrawal via automated teller machine shall be restricted to N100,000 subject to a maximum of N20,000 cash withdrawal per day and further restricted point of sales (POS) withdrawal to N20,000 daily.

It further stated that only denomination of N200 and below shall be loaded in automated teller machine (ATM).

The new policy encourage customers to use alternative channels such as internet banking, Mobile banking app, USSD, eNaira e.tc

After the policy takes effect, all cash withdrawals in excess of the stated limits will attract processing fees of 5% and 10%, respectively.

The new policy is coming barely weeks after President Muhammadu Buhari launched the newly redesigned N200, N500, and N1000 banknotes.